Digital News Feed Delivery

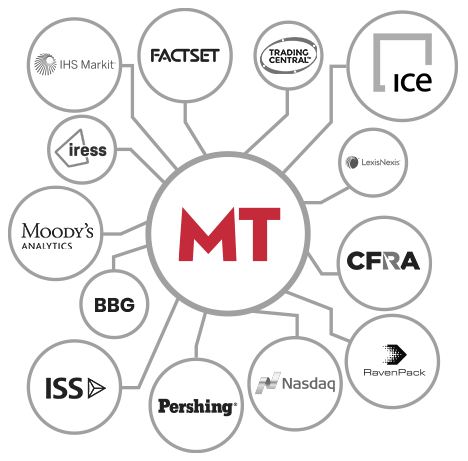

Need a complete, noise free premium financial news service solution for your application? Our popular real time Live Briefs digital news feeds are available directly from MT Newswires and from leading distributors and solution providers.

Direct Connection to MT Newswires (API, FTP, RSS)

Flexible feed formats and delivery options allow for quick and easy integration into any desktop or mobile platform.

23

years of original and unbiased reporting

28,000

+

original stories published each month

45,000

+

securities covered globally